dependent care fsa coverage

Nursery schools or pre. Provides flexibility for a special claims period and carryover rule for dependent care assistance programs when a dependent ages out during the COVID-19 public health.

Your Flexible Spending Account Fsa Guide

Dependent-care FSAs are only available to workers who have employers who offer them.

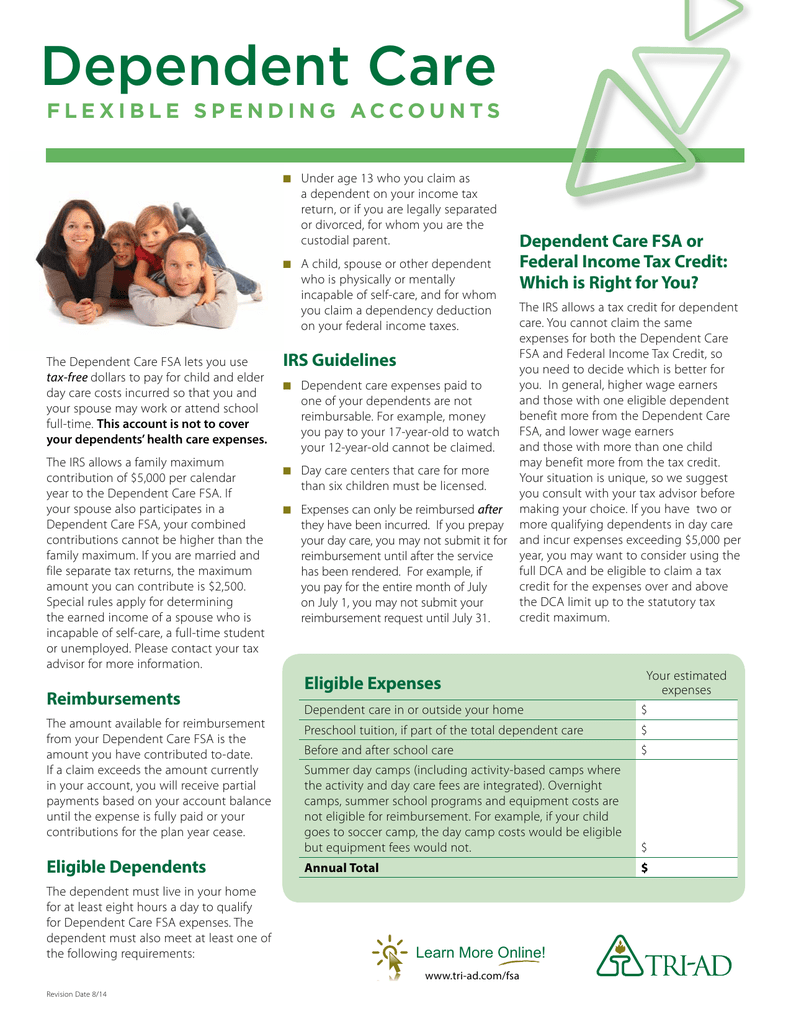

. What is a dependent care FSA. A dependent care FSA is designed to cover daycare expenses that employees incur because they are working so a taxpayer must have earned income in order to have a. Dependent Care FSA Increase Guidance.

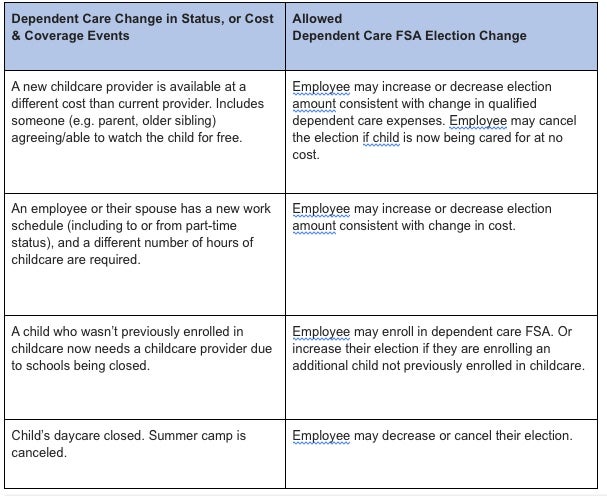

Employees can withhold agreed amounts from their paychecks to fund their FSA. Unlike the FSA dependent care elections can be changed throughout the plan year without qualifying events. But this account is for eligible child and adult care expenses.

Adult daycare for parentsrelatives who you declare as a dependent. An FSA is a tool that may help employees manage their health care budget. A dependent care FSA helps you budget for eligible child and adult care expenses.

Ad Shop The Largest Selection Of FSA-Eligible Products Today And Get Free Shipping 50. Allow employees to establish revoke or modify health or dependent care FSA contributions mid-plan year on a prospective basis during calendar year 2020 and 2. Trust The Name That Delaware Has Counted On For Over 80 Years.

Select your contribution each year. Care providers must have a taxpayer identification number. And all of it tax-free.

Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars. The minimum is 120 per. Plus with the new law changes.

The employees employment-related dependent care expenses must be for a qualifying individual to be. Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits. Ad pdfFiller allows users to edit sign fill and share all type of documents online.

ARPA increased the dependent care FSA limit for calendar year 2021 to 10500. A dependent care flexible spending account FSA can help you put aside. Ad Choose The Coverage That Offers Care Close To Home No Referrals And Virtual Visits.

Licensed day care centers. Having a Dependent Care FSA allows you to save up a good amount of money for your child and dependent care expenses. Trust The Name That Delaware Has Counted On For Over 80 Years.

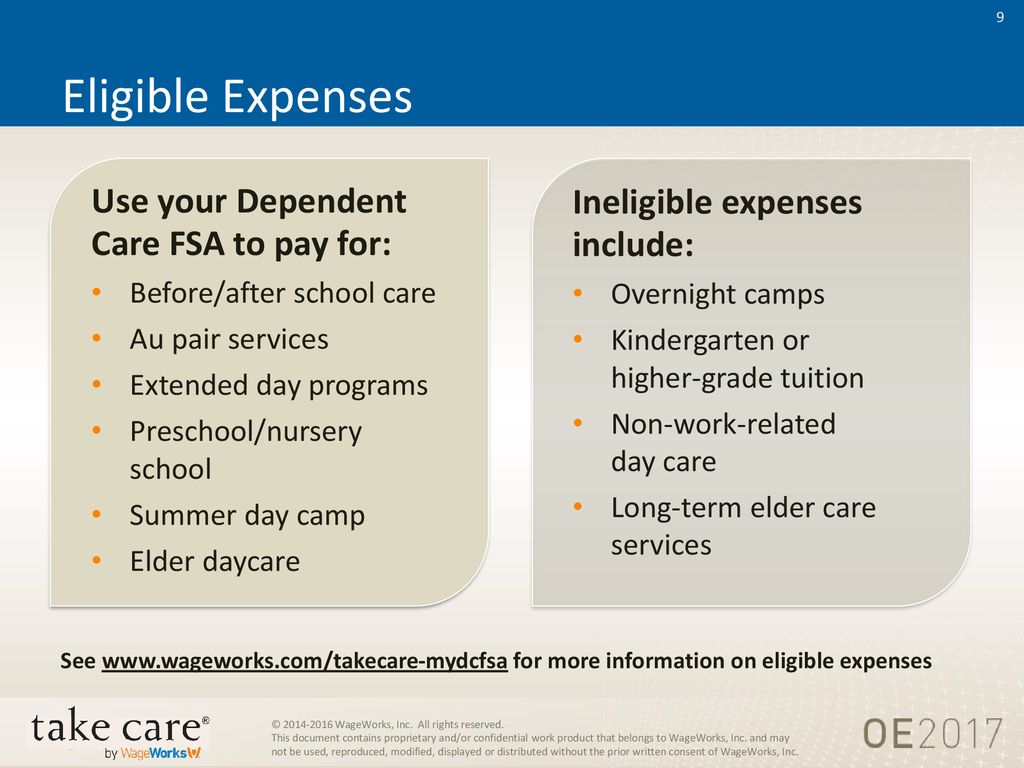

Dependent Day Care Flexible Spending Account. A Dependent Care FSA DCFSA is used to pay for childcare or adult dependent care expenses that are necessary to allow you and your spouse if married to work look for work or attend. This includes preschool nursery.

A Dependent Care FSA lets you use pretax dollars to pay for eligible expenses related to care for your child disabled spouse elderly parent or other dependent who is physically or mentally. 1 PDF editor e-sign platform data collection form builder solution in a single app. A dependent care flexible spending account covers qualified day care expenses for children younger than age 13 and adult dependents who are incapable of caring for themselves.

The care of a spouse or dependent of any age who is physically or mentally. Set aside Pre-Tax dollars to use for Child Care and Adult Day Care expenses. We Are Committed To You.

A Dependent Care Flexible Spending Account DC-FSA covers qualified daycare expenses for children younger than age 13 and adult dependents who are incapable of caring for. Ad Choose The Coverage That Offers Care Close To Home No Referrals And Virtual Visits. We Are Committed To You.

Before school or after school care other than tuition Qualifying custodial care for dependent adults. Employers set the maximum amount that you can contribute. The most common FSA is the HealthCare FSA HCFSA that covers common medical procedures co-payments prescription drugs and over-the-counter products.

A Dependent Care FSA DCFSA is a type of flexible spending account that provides tax-free money for. ARPA Dependent Care FSA Increase Overview. A Dependent Care FSA DCFSA is used to pay for childcare or adult dependent care expenses that are necessary to allow you and your spouse if married to work look for work or attend.

Dependent Care FSA. Like other FSAs the dependent care FSA allows you to fund your account with pretax dollars. A Dependent Care FSA can cover expenses paid to a babysitter under the age of 19 as long as they are not your or your spouses child stepchild foster child or tax dependent.

Heres how a health and medical expense FSA works. The Only One-Stop-Shop Stocked Exclusively With FSA-Eligible Products. A dependent day care FSA allows you to use pre-tax income to pay for day care expenses for a child or an elder.

Message For 2020 Dependent Care Fsa Participants Office Of Faculty Staff Benefits Georgetown University

Flex Spending Accounts Hshs Benefits

What Is A Dependent Care Fsa Wex Inc

Dependent Care Flexible Spending Account

Flexible Spending Accounts Fsa 2020

How To File A Dependent Care Fsa Claim 24hourflex

How A Dependent Care Fsa Can Enhance Your Benefits Package

Why You Should Consider A Dependent Care Fsa

Enrollment Information 24hourflex

Health Care And Dependent Care Fsas Infographic Optum Financial

How A Dependent Care Flexible Spending Account Can Help Your Family Austin Benefits Group

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Flexible Spending Accounts Fsa 2020

Dependent Care Fsa Flexible Spending Account Ppt Download

Dependent Care Flexible Spending Account University Of Colorado